Robert Marshall Council

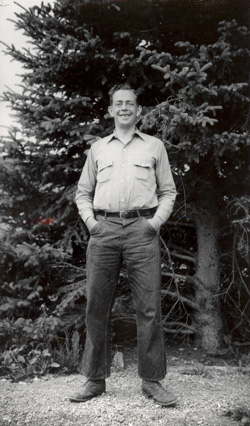

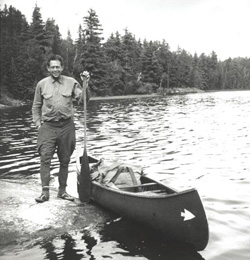

Robert "Bob" Marshall, principal founder of The Wilderness Society, set an unprecedented course for wilderness preservation in the United States and was a seminal figure in the formation of our nation's conservation movement. Marshall’s untimely death came a few short years after the formation of The Wilderness Society in 1935. Through his bequest to The Wilderness Society, his vision was realized: an organization of spiritied individuals to advocate for our most treasured wildlands.

Robert "Bob" Marshall, principal founder of The Wilderness Society, set an unprecedented course for wilderness preservation in the United States and was a seminal figure in the formation of our nation's conservation movement. Marshall’s untimely death came a few short years after the formation of The Wilderness Society in 1935. Through his bequest to The Wilderness Society, his vision was realized: an organization of spiritied individuals to advocate for our most treasured wildlands.

“There is just one hope of repulsing the tyrannical ambition of civilization to conquer every niche of the whole earth. That hope is the organization of spirited people who will fight for the freedom of wilderness.”

The first to make a gift to The Wilderness Society through his will, Marshall extended his life's work of protecting wilderness far beyond his lifetime through this special gift.

The Robert Marshall Council recognizes those who have made a future commitment to wilderness protection by including The Wilderness Society in their estate plans. We thank these special donors for their ongoing commitment to protecting our beloved public lands.

The Robert Marshall Council recognizes those who have made a future commitment to wilderness protection by including The Wilderness Society in their estate plans. We thank these special donors for their ongoing commitment to protecting our beloved public lands.

Members of the Robert Marshall Council receive benefits and special invitations, including:

- Insider updates from Wilderness Society President, Jamie Williams;

- Exclusive invitations to hear directly from our program staff through phone briefings, lectures, and events;

- Our special edition full-color Wilderness Society wall calendar;

- Lifetime subscription to The Wilderness Society’s newsletter, America’s Wilderness; and

- Recognition as a member of our Robert Marshall Council in our Annual Report.

Have you already included The Wilderness Society in your will or other estate plan? If so, please let us know so that we can thank you for your generosity and welcome you into the Robert Marshall Council.

More Resources

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.