Answers

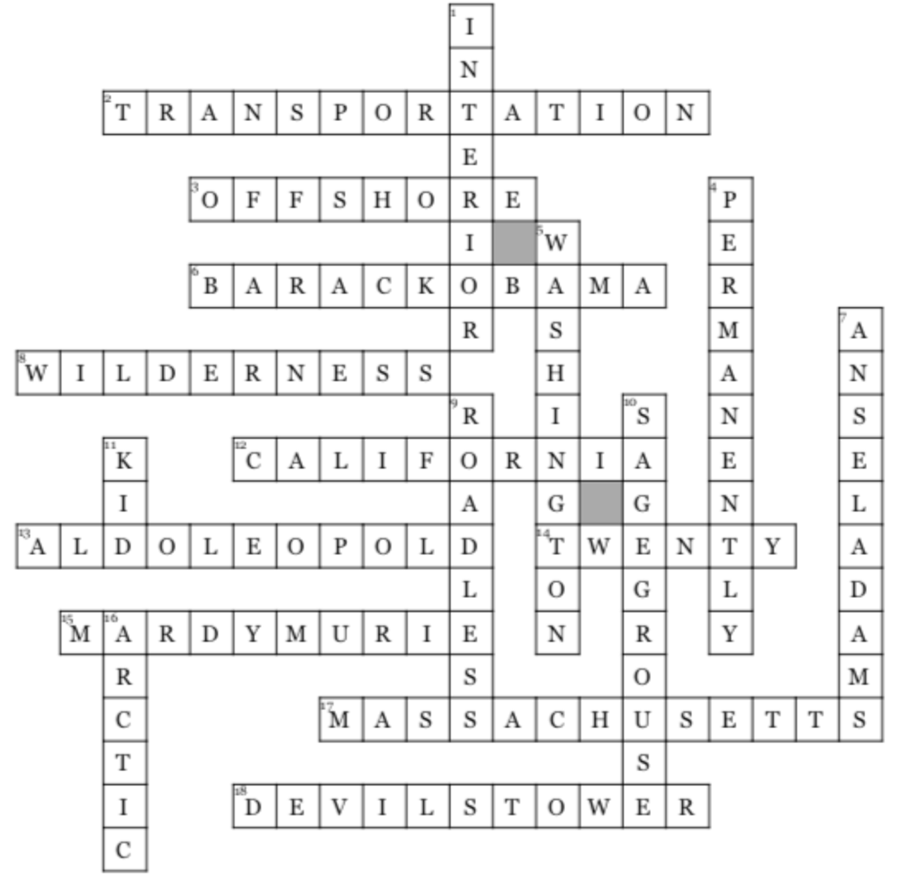

Across

2. All people deserve access to public lands, but for people from historically underserved communities one of the biggest barriers is a lack of _____.

3. As referenced in our upcoming Member Newsletter, as a direct result of a decision The Wilderness Society won in court, the Trump administration is putting its _____ drilling efforts on hold.

6. President _____ designated or expanded 34 national monuments during his presidency.

8. TWS mission: To protect _____ and inspire Americans to care for our wild places.

12. Arizona and this state share the title for most national monuments with 18.

13. This author of A Sand County Almanac was also a founding member of The Wilderness Society.

14. _____ percent of all U.S. carbon emissions come from fossil fuels extracted on public lands.

15. Former TWS Council Member, dubbed the “Grandmother of the Conservation Movement.”

17. The only marine national monument in the Atlantic is located off the coast of this state.

18. First national monument, established by President Roosevelt in 1906.

Down

1. This federal department manages more national monuments than any other.

4. Earlier this year, the Land and Water Conservation Fund (LWCF) was _____ reauthorized.

5. Both Booker T. and George have national monuments commemorating their lives in Virginia.

7. The Wilderness Society’s headquarters in Washington, DC houses a collection of photographs, open to the public, by this famous landscape photographer.

9. The _____ Area Conservation Rule limits road construction and the resulting environmental impact on designated areas of public land.

10. The BLM is currently trying to rollback conservation plans across Western states designed to protect this dancing bird, along with 350 other species.

11. The John D. Dingell, Jr. Conservation, Management and Recreation Act became law earlier this year and included the reauthorization of “Every _____ Outdoors” for seven more years.

16. TWS’ short film Welcome to Gwichyaa Zhee focuses on the plight of indigenous people who depend on the National Wildlife Refuge for their survival.

More Resources

Information contained herein was accurate at the time of posting. The information on this website is not intended as legal or tax advice. For such advice, please consult an attorney or tax advisor. Figures cited in any examples are for illustrative purposes only. References to tax rates include federal taxes only and are subject to change. State law may further impact your individual results. California residents: Annuities are subject to regulation by the State of California. Payments under such agreements, however, are not protected or otherwise guaranteed by any government agency or the California Life and Health Insurance Guarantee Association. Oklahoma residents: A charitable gift annuity is not regulated by the Oklahoma Insurance Department and is not protected by a guaranty association affiliated with the Oklahoma Insurance Department. South Dakota residents: Charitable gift annuities are not regulated by and are not under the jurisdiction of the South Dakota Division of Insurance.